scams

Avoiding Scams

Safe Practices to Use Online

Types of Scams and How to Avoid Them

Faux telemarketers - Con artists that call you trying to gain information about you or try to sell you some fake product.

Faux telemarketers can be avoided with just a few simple steps. First, don’t answers calls without caller ID. Second, NEVER give out personal information over the phone. Third, if someone is calling you about tech support, they are a liar, tech support will never call first. Fourth, if someone claiming to be from the IRS calls and aggressively tries to get you to pay money you “owe” to them, it’s more than likely a scam. These are just a few simple ways to avoid Faux Telemarketers.

Unexpected money/winnings scams - Someone trying to fool you into giving your bank credentials to receive illegitimate funds.

The way to avoid most of these money scams is simply common sense. You know that you didn’t enter into any contests, therefore you shouldn’t have actually won anything. These scams promise great things but will simply leave you with even less than you had before.

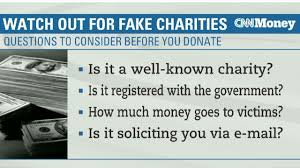

Fake Charities - A fake charity set up to fool people into donating money.

Fake Charities can be easily avoided by doing a bit of research into the matter. If you are feeling generous enough to donate your hard earned cash, you should look online to make sure that it is a legitimate charity and that the donations go to the places they say they go.

http://www.cnn.com/2013/06/13/us/worst-charities/

Fake Job or Investment Scams - A scam in which you are offered a job or investment opportunity that is false.

When receiving an email about a job offer, make sure to check that the address is

legitimate. If the address ends with a Gmail, Yahoo, or Microsoft Outlook domain,

there’s high chance it isn’t real. Another tip would be to search the company name

in quotation marks. If no direct results are found, the company clearly doesn’t exist

either.

When receiving an email about a job offer, make sure to check that the address is

legitimate. If the address ends with a Gmail, Yahoo, or Microsoft Outlook domain,

there’s high chance it isn’t real. Another tip would be to search the company name

in quotation marks. If no direct results are found, the company clearly doesn’t exist

either.

Advanced Fee Scams - A scam in which a fake person or business wants you to pay a fee upfront in order to receive a larger sum later.

Advanced fee scams can be avoided by doing research into what you are trying to invest.

An example of this would be someone you have never known or heard from in your life

calls you and tells you that you need to send money or gift cards to get them out

of a jam, invest in their bogus business, or get an advance on some money they are

owed. The simplest rule is if you don’t know the person or business don’t give them

money no matter how much they promise in return.

Advanced fee scams can be avoided by doing research into what you are trying to invest.

An example of this would be someone you have never known or heard from in your life

calls you and tells you that you need to send money or gift cards to get them out

of a jam, invest in their bogus business, or get an advance on some money they are

owed. The simplest rule is if you don’t know the person or business don’t give them

money no matter how much they promise in return.

Auction Fraud - An online auction in which a faulty product or an item that you didn’t want

Stay away from overseas sellers that try to have you pay through wire transfer. Similarly,

be aware of sellers suggesting escrow as a payment method. Amazon, and eBay do not

have an escrow service. Never complete transactions off trusted auction sites. When

making a payment through PayPal, be sure to check that the seller and payment addresses

match.

Stay away from overseas sellers that try to have you pay through wire transfer. Similarly,

be aware of sellers suggesting escrow as a payment method. Amazon, and eBay do not

have an escrow service. Never complete transactions off trusted auction sites. When

making a payment through PayPal, be sure to check that the seller and payment addresses

match.

Identity Scams - Scams that try to divulge or steal your identity.

Identity scams can be tricky. There are lots of ways to get a person’s identity. You

can check to see if your identity is stolen or being used for malicious purpose by

frequently checking your credit score. To avoid this scam never give out your personal

information over the phone, avoid shopping on bogus or sketchy websites, and shred

important documents before throwing them away. There is no way to be completely secure

about identity theft as it can be as easy as a waiter or waitress writing down your

card information behind the desk, or legitimate websites becoming compromised but

if you do these things it can certainly make you safer.

Identity scams can be tricky. There are lots of ways to get a person’s identity. You

can check to see if your identity is stolen or being used for malicious purpose by

frequently checking your credit score. To avoid this scam never give out your personal

information over the phone, avoid shopping on bogus or sketchy websites, and shred

important documents before throwing them away. There is no way to be completely secure

about identity theft as it can be as easy as a waiter or waitress writing down your

card information behind the desk, or legitimate websites becoming compromised but

if you do these things it can certainly make you safer.

Threat or Extortion Scams - Scams that place threats on your life or computer for financial gain. This can also be holding your system for ransom with ransomware.

If you have been sent an intimidating email featuring death threats and the like, take a deep breath and re-read the email. If there is personal information and the email looks like it was especially addressed to you, contact the FBI’s Internet Crime Complaint Center immediately. Notify them and ignore the email. Do not reply or offer money. Another form of extortion is ransomware which is software that encrypts your systems information and then you are contacted about how to buy your information back. The best way to protect against this is to keep your operating system up to date and get good virus protection.

Online Gambling Scams - A scam in which a fake site entices you to gamble in a cyber machine that will never let you win.

Gambling scams are bogus website that run script on the internet that never allows you to win anything but requires your money to play. The best ways to avoid this is to avoid online gambling or at least use sites that legitimate with lots of reviews and use online live action gambling “gambling with a real dealer on a webcam.”

Email Scams or Click Bait - These are scams that send fake emails or ads claiming that you have won something or that they are your bank and require your information in a return email to fix the issue. Where even if you reply they will send you even more spam.

If you receive an email stating you’ve won something without entering, immediately

be suspicious. First thing that should tip you off is if the sweepstake asks you to

pay fees to receive the prize. Legitimate sweepstakes will never ask you this. Another

tip-off is if the email comes from a large corporation, but at the same time has a

Hotmail, Gmail, or other personal email domain attached to it.

If you receive an email stating you’ve won something without entering, immediately

be suspicious. First thing that should tip you off is if the sweepstake asks you to

pay fees to receive the prize. Legitimate sweepstakes will never ask you this. Another

tip-off is if the email comes from a large corporation, but at the same time has a

Hotmail, Gmail, or other personal email domain attached to it.

Skimmer Scam - a device used on top of or inside a credit reader or ATM. It is used to steal your credit card number and pin.

The best way to avoid skimmers is to check the device itself for small discrepancies,

making sure that the device isn’t larger than another if in a retailing store. At

an ATM, be on the lookout for suspiciously placed things, loose plastic inside the

reader, or a cable leading out of the ATM. Another easy thing to do to protect yourself

at the ATM is to cover the pad completely when you put in your PIN. lastly, you should

try to avoid using ATMs with metal keys because people can come up behind you with

thermal camera’s and see the heat signatures from your keystrokes with a camera. With

this they can figure out your pin.

The best way to avoid skimmers is to check the device itself for small discrepancies,

making sure that the device isn’t larger than another if in a retailing store. At

an ATM, be on the lookout for suspiciously placed things, loose plastic inside the

reader, or a cable leading out of the ATM. Another easy thing to do to protect yourself

at the ATM is to cover the pad completely when you put in your PIN. lastly, you should

try to avoid using ATMs with metal keys because people can come up behind you with

thermal camera’s and see the heat signatures from your keystrokes with a camera. With

this they can figure out your pin.

Gift Card Scam - A gift card is scanned using either a mag scanner, or the number is simply copied by hand, and the person who does this simply checks occasionally to see if the card has been loaded with any money.

Gift Card Scams are scams which involve a person going into a store with gift cards

in an open area and taking the cards and either using a magnetic strip scanner or

by hand, copying the number of the card in order to use at a later date when someone

else has bought the card and has put money onto it. The best way to avoid this scam

is to never buy cards from an area where they are kept out in the open and where anyone

can get them. Another tell-tale sign is if the scratch off area is gone, though this

will not always be true for every gift card scam. One final and simple thing to help

protect yourself from this type of scam, don’t buy gift cards at online auction sites

ever.

Gift Card Scams are scams which involve a person going into a store with gift cards

in an open area and taking the cards and either using a magnetic strip scanner or

by hand, copying the number of the card in order to use at a later date when someone

else has bought the card and has put money onto it. The best way to avoid this scam

is to never buy cards from an area where they are kept out in the open and where anyone

can get them. Another tell-tale sign is if the scratch off area is gone, though this

will not always be true for every gift card scam. One final and simple thing to help

protect yourself from this type of scam, don’t buy gift cards at online auction sites

ever.

Written by Professor Greg Hirsch, Department of Information Technology, 04/21/2017

What to do if You Have Been Scammed

YOU’VE BEEN SCAMMED!

What recommended actions should you take?

1. Identify Whom You Are Dealing With

Look up the phone numbers they use to trace them back. If they called from a blocked number, dial *69 to call back. This will reveal the number that last called you. If scammed by email, report the email as spam and look up the email sender. If they tell you that they work with a company, remember it and do your research. Often you will find forums or report sites with people dealing with the same scammers. These sites could have useful information that you need to know about who or whom you’re dealing with. If lucky, they might have already traced the scammers back to their region. Hope for the scammers to be based in the U.S. as it is hard for law enforcement to pursue foreign perpetrators.

2. Always Inform The Authorities

Call a non-emergency number to report a cybercrime. Agencies use this data to fight cybercrimes. Your financial institution and/ or Credit Card Company will likely want a copy of the police report as evidence. This will get you closer to recovering your losses.

3. Contact Your Financial Institution and/or Credit Card Company Immediately

Tell them your card and/ or account has been compromised and ask them what are the necessary steps that they want you to take. Every financial organization has their own way of dealing with financial fraud and they will walk you step by step through their process. Some banks and card companies have recovery options available and you may be able to claim your lost funds. Remember, if your card or account has been compromised yet your money has not been touched, your information may have been sold or the scammer has not withdrawn the money yet. The rule of thumb is if your card has been compromised, then your account has been compromised and vice versa.

The Aftermath

If you lost a couple hundred, consider yourself lucky. Many times people do not realize

money is missing from their account until months or years because the scammer withdraws

so little amount they don’t even notice. These are what present the long term effects

like credit score depletion. This doesn’t sound serious until you get denied and not

be able to buy a new car or house.

If you lost a couple hundred, consider yourself lucky. Many times people do not realize

money is missing from their account until months or years because the scammer withdraws

so little amount they don’t even notice. These are what present the long term effects

like credit score depletion. This doesn’t sound serious until you get denied and not

be able to buy a new car or house.

Steps to Take

SSN or EIN was exposed

If a company responsible for exposing your information offers you free credit monitoring,

take advantage of it. Get your free credit reports from annualcreditreport.com, and

check for any accounts or charges you don't recognize. You can order a free report

from each of the three credit bureaus once a year.

If a company responsible for exposing your information offers you free credit monitoring,

take advantage of it. Get your free credit reports from annualcreditreport.com, and

check for any accounts or charges you don't recognize. You can order a free report

from each of the three credit bureaus once a year.- Consider placing a credit freeze. A credit freeze makes it harder for someone to open a new account in your name. If you place a freeze, you'll have to lift the freeze before you apply for a new credit card or cell phone - or any service that requires a credit check. If you decide not to place a credit freeze, at least consider placing a fraud alert.

- Try to file your taxes early - before a scammer can. Tax Identity Theft happens when someone uses your Social Security number to get a tax refund or a job. Respond right away to letters from the IRS.

- Don't believe anyone who calls and says you'll be arrested unless you pay for taxes or debt - even if they have part or all of your Social Security number, or they say they're from the IRS.

- Continue to check your credit reports at annualcreditreport.com. You can order a free report from each of the three credit reporting agencies once a year.

Online Log-in or Password was exposed

- Log in to that account and change your password. If possible, also change your username. If you can't log in, contact the company. Ask them how you can recover or shut down the account. If you use the same password anywhere else, change that, too. Is it a financial site, or is your credit card number stored? Check your account for any charges that you don't recognize.

Debit or Credit Card Information was exposed

Debit or Credit Card Information was exposed

- Contact your bank or credit card company to cancel your card and request a new one.

- Review your transactions regularly. Make sure no one misused your card. If you find fraudulent charges, call the fraud department and get them removed.

- If you have automatic payments set up, update them with your new card number.

- Check your credit report at annualcreditreport.com

Bank Account Information was exposed

- Contact your bank to close the account and open a new one.

- Review your transactions regularly to make sure no one misused your account. If you find fraudulent charges or withdrawals, call the fraud department and get them removed.

- If you have automatic payments set up, update them with your new bank account information.

- Check your credit report at annualcreditreport.com

Scammed through gift cards

- Legitimate institutions will never request gift cards as payment.

- Legitimate institutions will never threaten you or pressure you to send money.

- There is slim to no chances of getting your money back because it is difficult to trace and cannot be cancel like a credit card.

- The best thing to do is to call the credit card company and see if they have a policy or program that will be of help to you.

- According to the Apple gift card page: “iTunes Gift Cards are solely for the purchase

of goods and services on the

iTunes Store and App Store. Should you receive a request for payment using iTunes

Gift Cards outside of iTunes and the App Store, please report it at ftc.gov/complaint.”

iTunes Store and App Store. Should you receive a request for payment using iTunes

Gift Cards outside of iTunes and the App Store, please report it at ftc.gov/complaint.” - One way to avoid the iTunes gift card scam and any other scam that involves a money

transfer is never sending cash to someone you don’t know. When circumstances come

up where you need to exchange money for personal or business use, there are better

avenues to do so than iTunes gift cards, here are a few:

- Paypal

- Venmo

- Square Cash

- Google Wallet

- Amazon.com Gift Cards

Go to indentitytheft.gov site to file a report and get steps specific for your needs.

Written by Professor Greg Hirsch, Department of Information Technology, 04/21/2017